Forests therefore significantly strengthen a portfolio, particularly in the medium to long term. The growth of the global middle class and the associated demand for housing are continuously increasing the demand for timber. Wood is an ideal substitute for energy-intensive construction materials such as steel or concrete. In addition, wood serves as a raw material for numerous other products such as furniture, paper, or tissue. Above all, however, forests represent a green, CO₂-neutral and, in the truest sense of the word, sustainable investment. As a result, forests are a permanent component of the investment portfolios of institutional investors and families in many regions of the world.

Forest is more than just nature. It combines economic benefits with ecological responsibility and represents an attractive investment opportunity for both private and institutional investors:

As a long-established and experienced asset manager, our goal is always to generate stable returns for our clients through a sustainable and careful stewardship of the natural assets entrusted to us. To this end, we acquire high-quality forests worldwide on behalf of our clients and place great emphasis on site-appropriate, professional management.

When selecting suitable investment locations, we place particular importance on the following criteria:

Successful long-term investments in forest land require a high level of legal certainty and protection of property rights in the target country. As the investment horizon is generally at least 15 years, stable and clearly defined ownership rights are of central importance. Regions with inadequate legal certainty, weak property rights, corruption, or political instability are consistently excluded. High legal certainty is found primarily in Central and Northern Europe, North America, and Oceania, while parts of South America, Africa, and Eastern Europe are classified as unsuitable due to political risks and weak protection of property rights.

High legal certainty offer above all locations in Central and Northern Europe, North America and Oceania, parts of South America, Africa and Eastern Europe due to political risks and weak property protection are classified as unsuitable.

Climate and natural growth conditions are crucial for the profitability and stability of forest investments.

Fertile soils, balanced water availability, sufficient rainfall, and suitable temperature conditions are essential for continuous cash flows from biological growth – a central driver of value creation in forestry.

For a successful forest investment, access to well-developed and diversified markets is essential.

Strong domestic markets as in North America or Europe offer clear advantages here, as do Export-oriented markets as in Australia or New Zealand with connections to Asia. Regions with Weak or fragmented sales structures - like large parts Africa or Politically unstable countries in South America - salvage, on the other hand Higher marketing risks.

The entry price for forest and agricultural land is central to the long-term return of an investment.

Attractive locations are characterized by fair, market-based land prices in transparent and liquid markets.

A strong infrastructure with reliable transport, processing facilities, and logistics supports efficient timber production and sales. Established structures in North America, Oceania, and Northern Europe offer significant advantages.

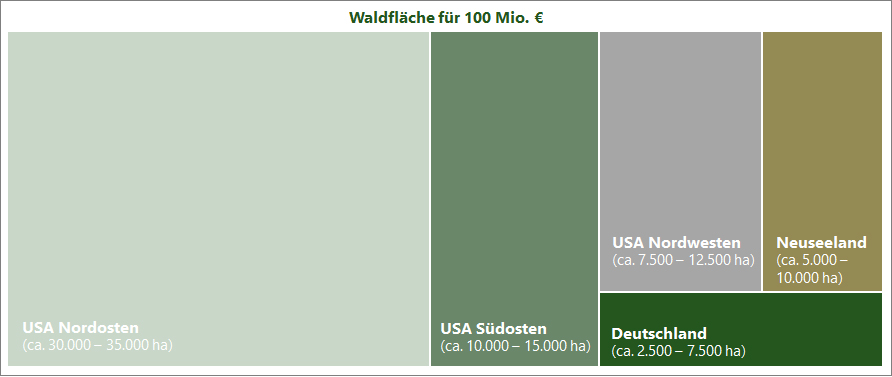

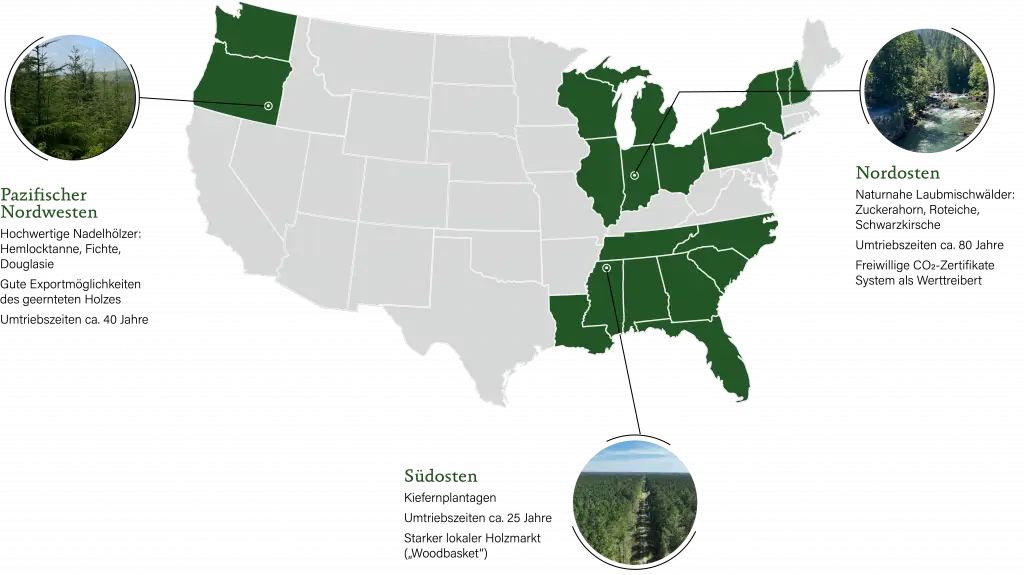

The USA offers one of the largest and most established forest and timber markets in the world - characterized by high liquidity, transparency and legal certainty. Access to fungible land markets, a strong domestic market and high demand for timber make the USA an ideal investment location. We focus on acquiring forests in the USA for sustainable and profitable timber production, value creation and CO₂ certification. Our professional in-house management by our locally based team ensures sustainable management and close cooperation with experienced local service providers.

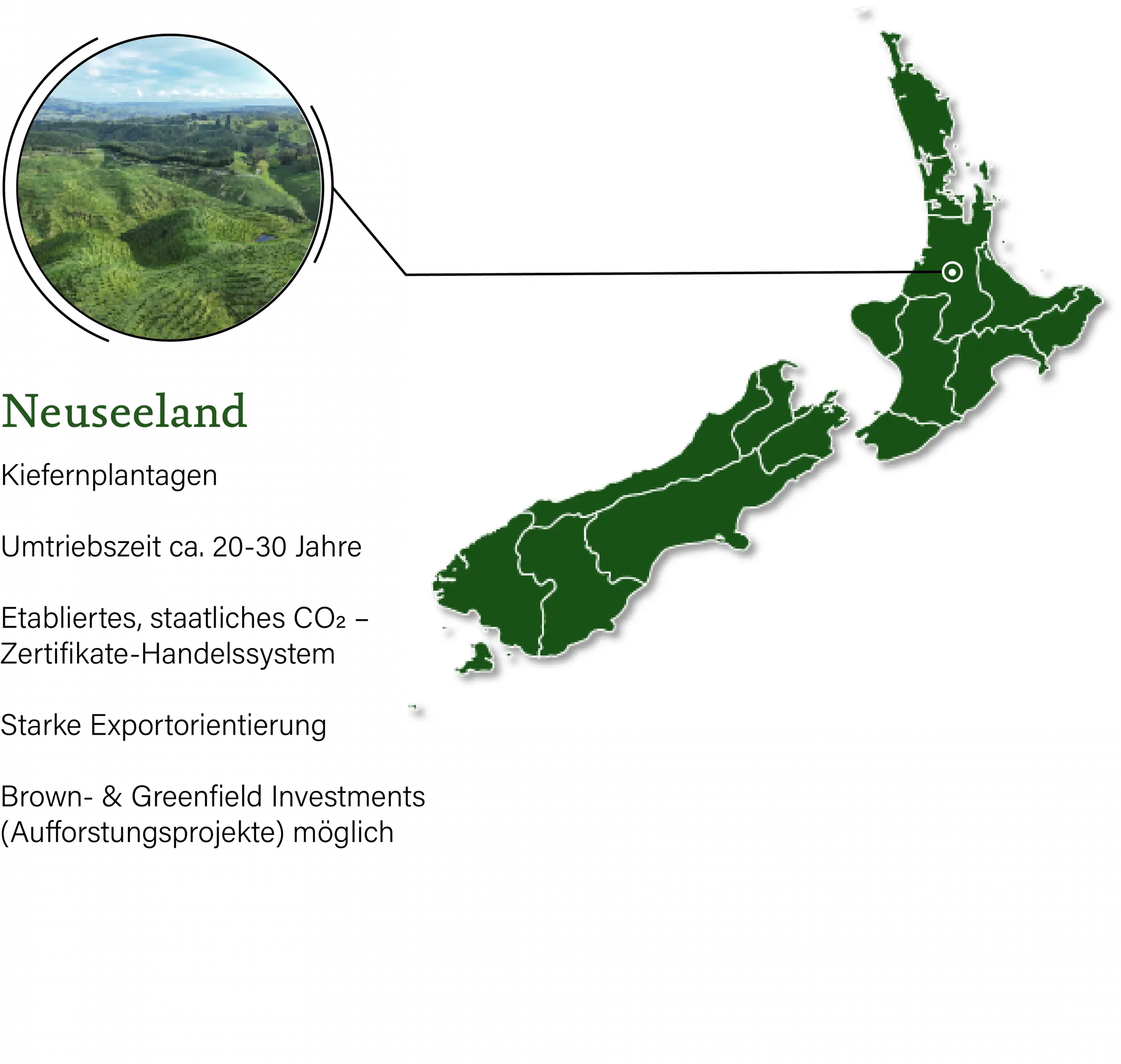

New Zealand is one of the most attractive locations for sustainable forestry investments. In addition to optimal growing conditions and short rotation times, the country's established, state-regulated CO₂ certificate trading system is particularly impressive - a key driver of value and returns. Together with our local partners, we invest in both existing forest stands (brownfield projects) and reforestation projects (greenfield investments). Our sustainable management not only includes the professional management of forests, but also the active generation and management of CO₂ certificates - as an additional return component for your investment.

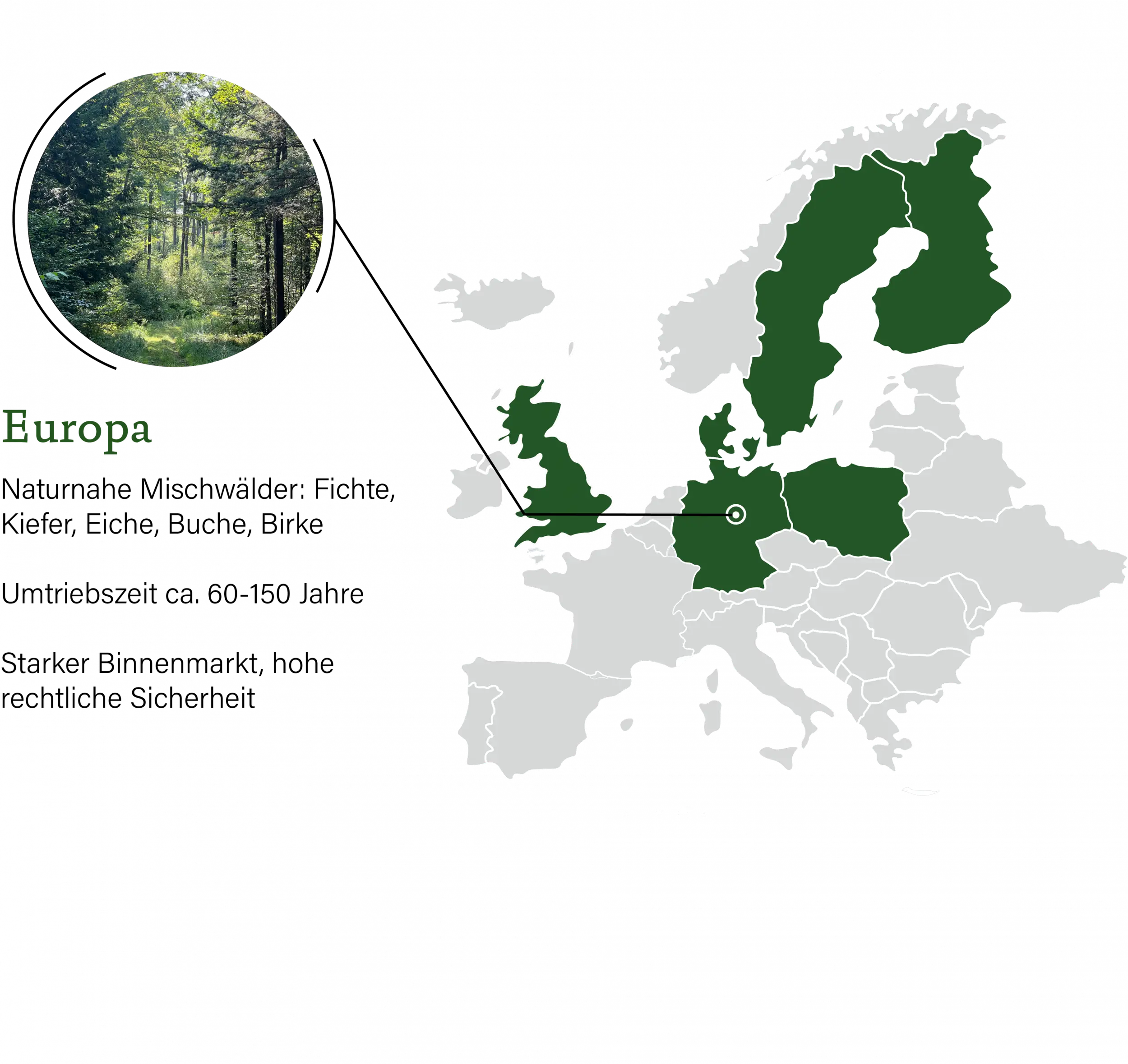

Europe - especially Germany, Scandinavia and the United Kingdom - is one of the most established locations for sustainable forestry investments. In addition to a high level of legal certainty and stable ownership structures, these markets are characterized by their professional structures, well-developed infrastructure and established certification systems. The region offers very good to good growth conditions, with Scandinavia currently being one of the most attractive target markets for forest investments.

To provide you with an optimal experience, we use technologies such as cookies to store and/or access device information. If you consent to these technologies, we may process data such as browsing behavior or unique IDs on this website. If you do not give or withdraw your consent, certain features and functions may be impaired.